Students should start building credit as soon as possible.

A high credit score can make it much easier for you to take out loans and credit which will be invaluable when it comes time to start job hunting and buying assets like property. A poor score, on the other hand, can be a real pain because it may stop you from getting loans for things that are necessary.

In the UK, financial institutions have been known to take a customer’s credit score into account when providing them with mortgages and loans. If your score is too low then you may not get any offers at all. If this happens, you will struggle to afford loans for your home and car.

What is a credit score?

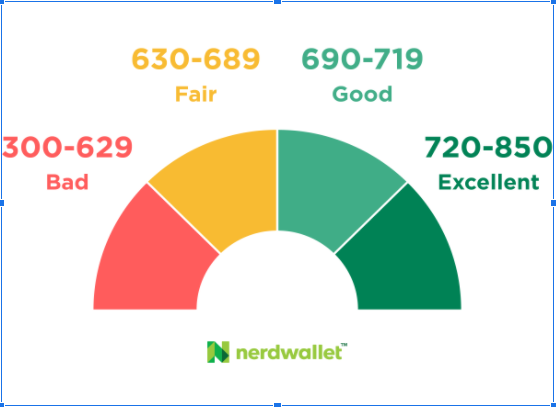

It’s a score from 0-1000 that lenders use to work out if you are a high credit risk. This is very important as it will affect the amount of interest they charge you.

The higher your score, the lower your payments will be, and vice versa.

What is a credit rating?

A credit rating is a ‘band’ of your credit score, such as low, fair, good, very good, and excellent.

Getting hold of an accurate credit report is often difficult for someone who is young and has no history in the credit world. However, it is possible to improve your score with a little hard work and perseverance.

How does your credit score impact your life?

Your credit score can make a difference when you:

- Buy your first car

- Sign up for your first credit card

- Rent or buy a home

- Apply for a student loan

- Look for a new job

Your credit score is also important because you need to know if you are responsible enough to manage your accounts properly.

How can I check my credit score?

You can check your credit score with one of the many companies that offer this service. By checking your credit report regularly, you will be able to keep track of what information the three main credit bureaus have about you.

This will make it easier for you to correct any mistakes that could be negatively impacting your credit score.

How can I check my credit score for free?

Plenty of companies provide you with your credit score free of charge.

Many people believe that only the big three credit reporting bureaus (Experian, Equifax, and TransUnion) can offer you a free report but this is not always true. Some companies such as Quizzle, FreeScore, and Credit Karma all give you the chance to access your credit score for free.

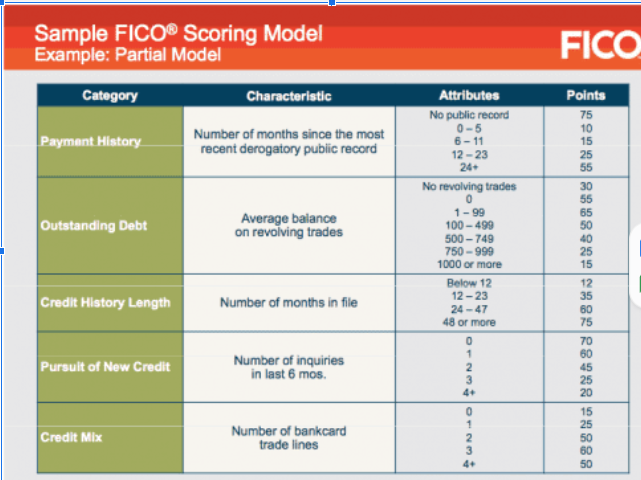

How is the credit score calculated?

The credit score is calculated based on the information in your reports. Your report contains various types of data, including:

- Your current and past addresses

- The amount you owe to creditors and lenders

- How frequently do you make your payments on time?

- Whether or not you have been sued for debt repayment?

As a student, you will only have a couple of years’ worth of credit history. However, this does not mean that your credit score cannot be worked out. A good way to start is by checking whether your score is excellent or if it is more towards the average range.

If it is low, don’t panic! Several factors could be responsible. For example, the credit bureaus might have little information on you because you have had a short credit history. In addition, the credit scores of students are usually low as they do not have as much money as older people with full-time jobs.

What details does a credit report contain?

A credit report contains your address, criminal background, employment history, credit score, and how much debt you owe.

It also shows any negative information included by the lender such as:

- Late payments,

- Credit defaults, and

- Account closures.

How to increase my credit score?

- Once you have a copy of your credit report, you will be able to start understanding where the problem is. Take note of any information that might need updating. This could include incorrect dates or loan amounts. You may want to contact the lenders, debt collectors, and others who are mentioned in your report and ask them to correct their records or provide further information. Some of this information is incorrect and needs to be changed for your score to improve.

- As a student, you may not have many credit accounts open. Creditors and lenders want to see that you can manage money responsibly, so they will be more inclined to give you one if you already have some accounts open.

First of all, find out if you have any credit cards and check the interest rate. If it is high, you might want to consider opening an account with a different bank or lender that has lower rates. The more accounts that you open, the better your score will be because it shows lenders that you are responsible and that you have a good track record of managing money.

- Make sure that you are only using a small percentage of your available credit. It is recommended that you should not exceed 30% of your total credit limit because this shows lenders that you cannot afford to use too much of their money. You can raise your score by making more than the minimum repayments on your accounts, thus lowering your outstanding debt.

- If you already have a credit card, make sure that you repay the balance in full every month and on time. Paying more than the minimum amount will help to increase your score faster. Having a low level of debt is also considered to be good for your credit score because it shows that you only use the credit that you need.

- Make sure that all of your bills are paid on time to show creditors and lenders that you can use their money responsibly.

- You might also want to consider applying for a protection plan if you have poor credit, which will allow you priority access in case something happens. You can get insurance against events such as job loss, illness, or involuntary unemployment. This will ensure that you can maintain the same standard of living if anything happens to you unexpectedly. It is best to take out protection plans when you are younger because premiums decrease with age.

What can bring down my credit score?

Source: CreditMantri

- You should avoid opening too many new loans or card accounts as this will not look good on your credit report. This is why it is important to ensure that all of your account information is correct before applying for any type of loan because the bureaus might decline applications if you have too much outstanding debt.

- Having a few late repayments on your report will also lower your score because lenders and creditors will see that you are not as reliable as those who always pay on time.

- It is best to avoid closing any accounts if you can as this may bring down your credit score. However, there may be times when it is necessary to close an account – for example if you know that you will not be able to make the repayments.

- You should also avoid taking out any new credit when your score is already low and factors such as a job loss or illness may be affecting it. It is much better to wait until your situation has improved, even if this means that you cannot buy anything for a while.

- Having too many credit inquiries may lower your score because creditors and lenders will see that you might be having financial difficulties. It is recommended that you should only apply for one loan or card at a time, rather than trying to get several in a short space of time.

How can I improve my credit score as a college student?

- Establish a credit history as early as possible.

- Check your credit report regularly for inaccuracies, and take steps to address them. You can get one free copy of your credit report from each of the three major bureaus every 12 months. AnnualCreditReport.com is the only authorized website for free annual credit reports.

- Make payments on time and pay your bills in full as often as possible. Your credit can be damaged by late or missed payments, even if the installment loan is for a cell phone or utility bill.

- Don’t apply for too many new credit cards or loans at once. Even though college students are swamped with financial aid offers, you should apply for credit only when you need it. And remember – your name and college address may end up on a list that lenders give to their telemarketers, which will probably increase your junk mail substantially.

- Be aware of what’s being reported about you to the three major credit bureaus – Experian, Equifax, and TransUnion. Each bureau collects different information about you and your credit habits, which is why it’s important to check them regularly. If something negative appears on one report but not the others, it could be that the lender didn’t notify all three bureaus or that the creditor made a mistake.

Do study loans affect one’s credit score?

The study loan is not an actual loan, there is no interest rate or any other charges that might affect your credit score. The student loans are given without any need for guarantors or security and it only requires the confirmation of attendance in the college/university. Hence, you don’t need to worry about your student loans while trying to work on your credit score.

Please make sure if you are looking for student loans, don’t get scammed by lenders asking for upfront fees. Also, be aware of your credit score and how it might affect your future financial plans. Be careful and good luck with your studies!

0 responses on "Start Building Your Credit Score When You are Still in College!"